USOIL Crude Oil Backtesting Journal

Hey guys,

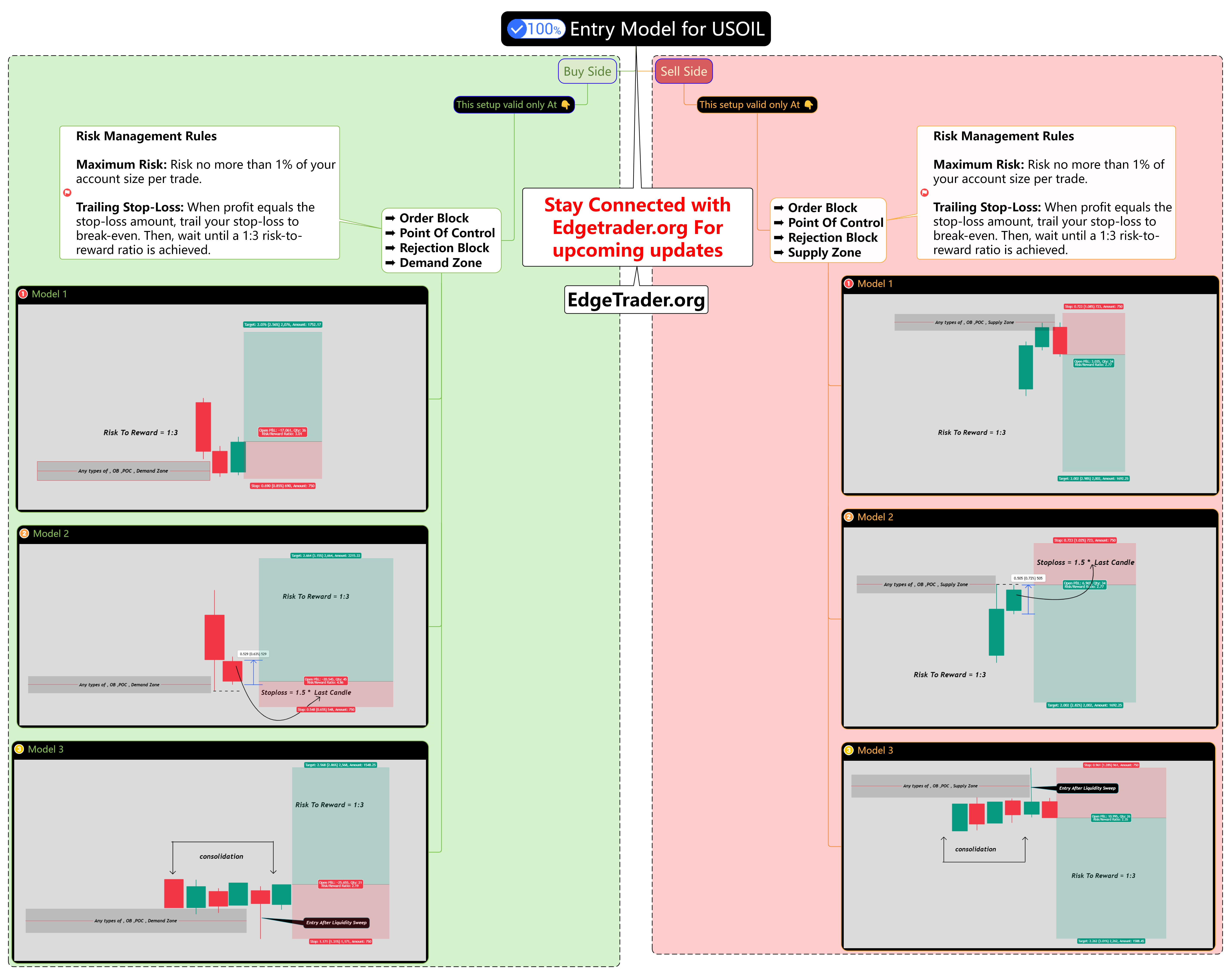

This is Rahulchaurasiya here, founder of EdgeTrader.org . After months of deep research, I’m excited to share my backtesting insights with you all. We’ll dive into how many key factors we need to cover when backtesting any trading instrument. To kick things off, let’s start with USOIL – I know most of you traders are familiar with it, but maybe you’re struggling to figure out how to build a solid system around it. No worries, I’m here to guide you step by step on how you can do it yourself.

A lot of traders ask why we choose USOIL for trading or backtesting. Well, here are some simple reasons why it’s one of my favorites:

Clean, decisive moves with high volatility: With USOIL, you get those sharp, predictable price swings – often 2-3% in just an hour – perfect for quick intraday setups without the choppiness of other assets.

No heavy manipulation or stop-loss hunting: Unlike some forex pairs or stocks, USOIL’s market is driven more by real fundamentals, so you avoid those sneaky traps that eat into your stops.

Tied to real physical value as a commodity: It’s not just hype – USOIL reflects actual supply and demand from global events, geopolitics, and economic data, making it more grounded and easier to backtest for long-term edges.

Let’s get into it!

We publish backtesting ideas on a daily basis. Below, you can check the comments. If you have any doubts, you can simply reply and ask about it.

Start From January 2, 2025. - 👇

Thanks for joining us.